![]()

SmartStart is geared toward young adults, age 16-26, who would like to take their first step toward financial empowerment. Whether you’re a student, working, or just establishing a banking relationship, SmartStart Checking is for you.

To find out more about accounts and other student programs offered by Cardinal, click on the tabs below.

SmartStart Checking Account Perks:

The Cardinal Smart Option Student Loan® by Sallie Mae®

*For borrowers attending degree-granting institutions.

Now you can pay for college the smart way with three great repayment options and competitive interest rates!

The loan is an ideal solution to help you pay for college expenses not covered by scholarships and federal loans.

The Smart Option Student Loan features and benefits:

- We offer a choice of competitive fixed and variable interest rates, providing even more choice and flexibility

- No origination fees and no prepayment penalty

- Multiple in-school repayment options available

- Borrower benefits available—like rewards and interest rate reductions

- Rates that reward creditworthy borrowers

- Applying with a creditworthy cosigner may help you qualify and/or receive a lower rate

- 24/7 online account management

GET THE MONEY YOU NEED FOR SCHOOL

Competitive interest rates

3 repayment options

No origination fee

Smart Option Student Loan®

Student VISA Card

Your busy lifestyle requires flexibility. Choose a VISA® card that can meet or exceed your expectations.

No Annual Fee

No Balance Transfer Fee

No Cash Advance Fee

1.99% APR

It pays to excel, and so does Cardinal!

Students receive a $1 reward for every “A” earned on their quarterly report cards. The money is deposited directly into their savings accounts.

Refer A Friend – Get $25!

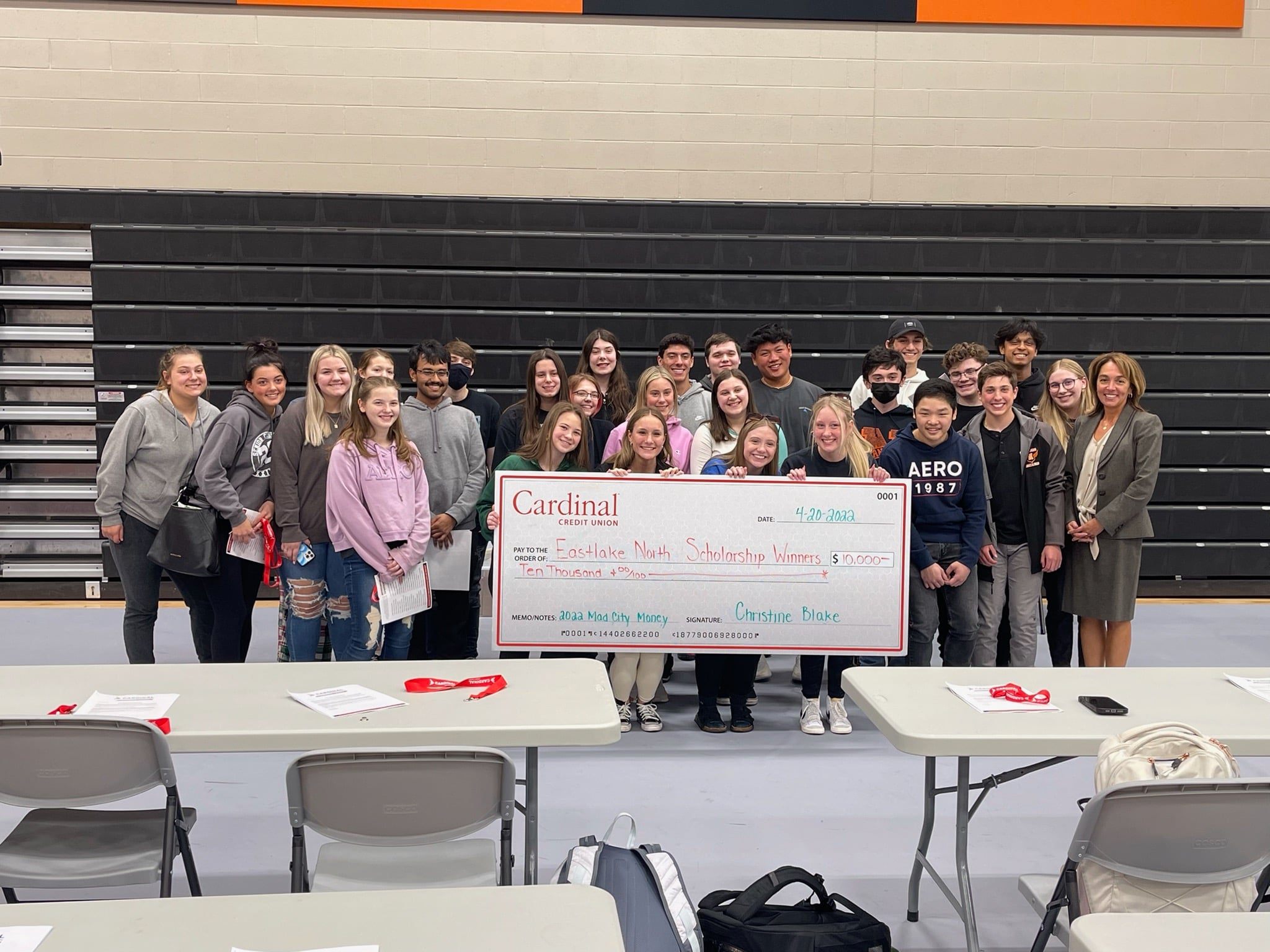

Select grade levels are eligible to participate in “Mad City Money,” a live facilitated educational event sponsored by Cardinal. This 90-minute game challenges young people with the financial responsibilities of adulthood.

Mad City Money is similar to the game of Life. Students will take on the role of adults in futuristic Mad City and be given jobs, income, a family and, of course, debt.

The challenge? Students will visit merchants to purchase housing, transportation, food, clothing, day care, and other wants and needs, all while building a budget. The simulation is a fun, eye-opening competition that gives you an idea of what life is like on your own.